The Federal Inland Revenue Service (FIRS) has recently issued Information Circulars clarifying many provisions of the Finance Act, 2019.

There are Seven different Information Circulars dealing with different topics under the Finance Act, 2019 as follows:

- Information Circular on Companies Income Tax related provisions of the Finance Act, 2019. Download here.

- Information Circular on Value Added Tax related provisions of the Finance Act, 2019. Download here.

- Information Circular on Stamp Duties related provisions of the Finance Act. Download here.

- Information Circular on provisions pertaining to Real Estate Investment Companies. Download here.

- Information Circular on provisions pertaining to Insurance Companies. Download here.

- Information Circular on provisions relating to commencement of business, cessation of business and re-organisation of business. Download here.

- Information Circular on provisions of the Finance Act as it relates to Securities Lending Transactions. Download here.

We will be organising a 3-part (1.5 hr each) webinar series to discuss the contents of the Information Circulars vis a vis the provisions of the Finance Act, 2019 and we will be highlighting what it all implies for taxpayers in simple practical terms.

The webinars will hold everyday from Tuesday, 19 May 2020 to Thursday, 21 May 2020, from 12.00pm to 1.30 pm on each of the days.

On day 1, 19 May 2020, we will focus on detailed discussions on the implications of the contents of FIRS’ Information Circular on Companies Income Tax.

On day 2, 20 May 2020, we will discuss FIRS’ Information Circular on Value Added Tax and its practical implications.

On day 3, 21 May 2020, we will discuss FIRS’ Information Circular on Stamp Duties, commencement of business, cessation of business and business re-organisation.

This three-part webinar series is offered at a one-time registration fee of N30,000 per attendee.

Please visit this link to register for the webinar: https://us02web.zoom.us/webinar/register/WN_UQ6o6FabQraXY7aSJSWKXQ

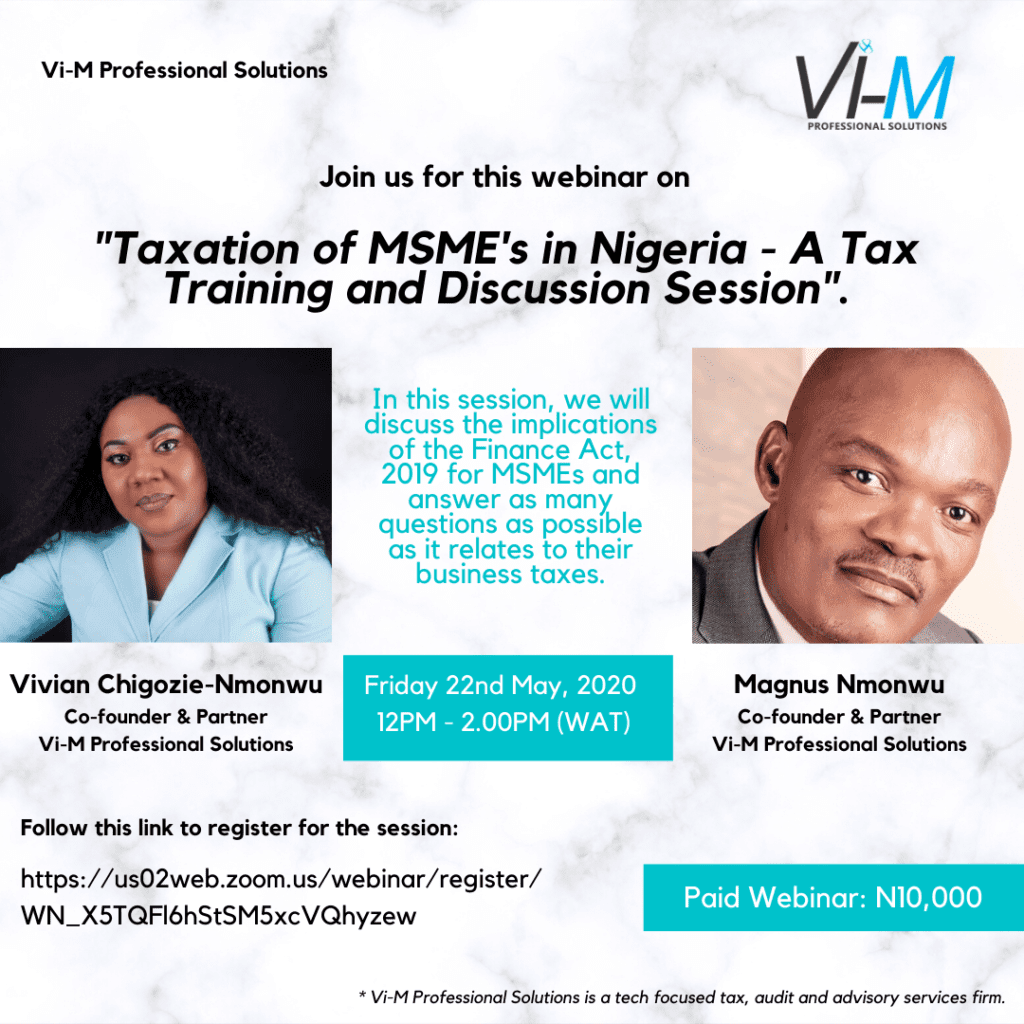

On day 4, 22 May 2020, from 12.00pm to 2.00pm, we will have a special wrap-up session titled: “Taxation of MSMEs in Nigeria: A Tax Training and Discussion Session”.

This is driven by the fact that many small and medium sized business owners still find it difficult to comprehend tax and how it applies to their businesses.

The periodic changes in tax laws do not also help matters. The Finance Act, 2019 presents a major change in Nigeria’s tax regime that is partly but not totally beneficial to MSMEs.

The clarifications made by the FIRS in its recently released Information Circulars on the Finance Act, 2019 even places more tax burden on MSMEs than earlier presented by the provisions of the Finance Act, 2019.

Through this 4th day wrap up webinar, Vi-M will:

1. Discuss the implications of the Finance Act, 2019 for MSMEs, particularly as presented by the Federal Inland Revenue Service in its recently released Information Circulars; and

2. Answer as many questions as possible as it relates to taxes for MSMEs.

This webinar is offered at a registration fee of N10,000 per attendee.

Please visit this link to register for the MSME webinar: https://us02web.zoom.us/webinar/register/WN_X5TQFl6hStSM5xcVQhyzew

Find below the event flyers for both webinars. To learn more about the webinars, please send an email to clients@vi-m.com.