Tax Discourse

(With Vi-M Professional Solutions)

Let’s talk through your tax issues!

Would you like to have access to expert tax advisory/ tax guidance on-the-go? And also save significant costs in purchasing it?

Would you like to avoid huge retainership fees for an accountant; end endless search for someone who can give you expert and professional tax guidance, as and when you need it; get over the fear of having your tax issues leaked to the wrong hands.

Are you currently struggling with tax issues and needing professional advice on how to navigate them?

Are you in tax trouble or undergoing tax audits or in need of expert tax guidance or cost effective way out?

Would you like to know how taxes specifically apply to your business so you can plan around them?

Are you getting a bit confused about what taxes (or tax exemptions) that will now apply to you or your business with all the changes in tax laws brought about by the yearly Finance Acts?

Would you like to gain knowledge from other business people on how they are navigating their tax issues?

Are you a student or tax professional needing to know more about certain taxes?

Would you like to get professional guidance on how to set up taxes on your accounting or ERP software/ systems? or with tax accounting and disclosures for your financial statements?

Do you happen to know someone who is in any of the above categories and needing tax advisory support?

Here is a solution for you!

‘Tax Discourse’, with Vi-M Professional Solutions.

‘Tax Discourse’, with Vi-M Professional Solutions is an avenue through which we at Vi-M, make personalised and professional tax advisory accessible and very affordable to every Nigerian taxpayer; an initiative, which will enable us support the everyday Nigerian taxpayer with strategic insights and knowledge (on an on-going basis) on how to better navigate any tax challenge.

‘Tax Discourse with Vi-M Professional Solutions’ is offered in 2 ways.

First is ‘Tax Discourse Webinars’:

A four to six hours tax advisory webinar session (to recur periodically);

To be held via zoom;

Where participants with tax issues, worries or concerns can unburden themselves and get personalised professional tax advisory/ guidance from our expert tax advisors;

Participants can also build tax knowledge from the solutions proffered to other participants;

After the webinar follows a free 10-minute one-on-one clinic per participant requiring further clarifications on their tax issues;

All at a very affordable fee of N5,000 per participant, per session! (less than the cost of an evening sit out); and we will talk through your tax troubles and help you save considerable tax costs!

Next session will be announced soon.

*Limited slots are available per session, to enable us adequately cater to all participants during the webinar.

.

And the second is ‘Tax Discourse (On-Demand)’

Designed for taxpayers in Nigeria who require tax advisory or guidance on-the-go; or those who would prefer private sessions to the webinar sessions,

Tax Discourse (On-Demand) is on-going private tax advisory chat sessions, to be held on-demand, for every taxpayer in Nigeria in need of tax advice or guidance.

At a fee of N750 per minute only, allowing taxpayers the flexibility of effectively managing tax advisory costs. Typically, many people who call in for tax guidance/ help get all the answers in less than 2 minutes. The call only lasts longer if the taxpayer takes longer in explaining his or her issues.

Just pay for the one minute (N750 per minute) or few minutes you spend with our expert tax advisors on the phone, anytime you need tax advisory. Pay only when you need it; book anytime and any day!

Taxpayers can book for tax discourse (on-demand) any day (though we recommend keeping Sundays holy!), and any time of the day between 8.00am to 6.00pm.

Chat sessions are to hold through voice or video phone calls – taxpayer to choose.

.

Countless number of taxpayers are suffering in silence!

There is scarcity of good tax knowledge out there and the tax laws are so vast that not one professional services firm can draw up a tax literature book that comprehensively captures all the ramifications of tax laws or tax issues one can encounter in Nigeria.

Even if they did, no one taxpayer needs all of the information at the same time.

So you find bits and pieces of tax information, tax alerts, tax webinars and even rumours out there, each dealing with a relatively small aspect of taxation or speaking to one or two tax solutions or issues for some group of taxpayers or another, at each point in time.

For taxpayers who can afford it, and who know how or where to get good and professional tax advice, the solution to this problem has been to engage professional tax advisors on call or retainership.

While millions of taxpayers who need professional help with their taxes but cannot afford it, or do not know where to get good and professional advice, suffer in silence.

Many are afraid that their business and tax information will be leaked to the tax man.

With Tax Discourse, this silence can be broken and the problems solved.

With a token of N5,000 (or N750/ minute for the on-demand private sessions) any taxpayer or interested participants can join a live advisory session to unburden themselves of their tax issues and get personalised professional guidance or help or strategic tax planning solutions.

No stories at all. No leakage of your confidential information in whatever form. No disappointments, a 10-minute each, one-on-one sessions will follow the general session to ensure that everyone requiring further attention is adequately attended to.

Or

.

So many frequent changes in tax laws!

For many years up until year 2020, just a few changes have been made to very few tax laws.

All of a sudden, with the Finance Act 2019, seven important tax laws changed and brought with it drastic changes to how the taxes apply to practically EVERY taxpayer and tax stakeholder in Nigeria.

In 2021, the Finance Act 2020 was also issued, bringing with it, 81 changes to 14 tax and related laws.

In 2022, another Finance Act will be issued to support the realisation of Nigeria’s 2022 budgeted revenues (as indicated by Nigeria’s ruling party).

How can a Nigerian taxpayer effectively navigate this ever changing tax terrain in Nigeria without very good, affordable and continuous professional tax advice?

Tax Discourse with Vi-M Professional Solutions is bridging this gap and solving this need on an on-going basis for just N5,000 per participant, per session. (or N750/ minute for the on-demand private sessions).

Or

.

Tax officials in Nigeria are hard to deal with!

Ever had a tax audit or query or the tax man’s visit in Nigeria?

Most times the best way people save themselves from the endless drama and headaches is to get their tax consultant or tax advisor to deal with the tax officers directly.

But what if you have no tax consultant and cannot afford a good one at the moment?

You can get help speedily and affordably through Tax Discourse with Vi-M Professional Solutions.

Get on the session and get strategic insights on how to deal with the tax man’s queries or visits, on your own peculiar situation for just N5,000 per participant, per session (or N750/ minute for the on-demand private sessions).

Or

.

Who is Tax Discourse for?

Everyday business people who are interested in how tax will impact their businesses and business incomes;

Everyday business people and income earners who do not like tax! and are looking for legitimate ways to avoid taxes;

Businesses undergoing tax audits and seeking strategies or approaches to legitimately and favourably navigate the audit;

Taxpayers who might be getting a bit confused about what taxes (or tax exemptions) that will now apply to them or their businesses, with all the changes in tax laws in 2020 and now in 2021;

Start up businesses that need to know all what they are required to do with regards to tax;

Small businesses earning less than N25 million in annual gross turnover, seeking to learn the extent of tax exemptions granted to them;

Non-residents doing business in Nigeria and seeking to know how taxes may apply to their operations, business dealings and /or permanent establishments;

Non-residents seeking to know what constitutes significant economic presence or otherwise, for the purpose of the business they do in Nigeria or their digital platforms used by Nigerians;

Tax practitioners or finance professionals who need peer reviews or discourse on tax issues;

Employees seeking to know exactly what taxes their employers are allowed to deduct from their pay and how employers are meant to account for such deductions for the their benefits;

Accounting or ERP systems experts or the businesses implementing accounting or ERP systems, who would you like to get professional guidance on how to set up taxes on their accounting or ERP software/ systems;

Businesses, accountants and auditors needing help with tax accounting and disclosures for their financial statements.

Or

.

Tax Discourse is also for:

Contractors who would like to know what taxes they must charge customers, those that customers are allowed to deduct from their pay and how customers must account for such deductions for their benefit;

Real estate players getting into all kinds of deals and transaction structuring, and who need to know what taxes may apply to each transaction, to their businesses and/ or how to legitimately avoid taxes totally;

Retailers who sell variety of goods and need to know which of the goods are tax exempt or not;

Manufacturers seeking to know what raw materials, overheads and finished products are taxable or not, and how to achieve tax savings and efficiency overall;

Wholesalers and distributors dealing with suppliers, imports (where applicable), agents, sales reps and customers who wish to know how to mitigate tax risks;

Tech companies whose operations are highly scalable, and consequently have highly scalable tax risks if not properly managed;

Companies dealing in Crypto monies and assets, that require knowledge of how their business operations will be taxable;

Airlines and shipping companies seeking to know how taxes (or tax exemptions) apply to them;

Financial services companies dealing in all kinds of financial instruments and seeking to find out what taxes or tax exemptions may apply to the instruments they deal in;

Or

.

Still think you are not covered by Tax Discourse? Tax Discourse also caters to:

Female entrepreneurs whose natural inclinations are to plan ten or more steps ahead, proactively seeking to mitigate all risks;

Bloggers and online business owners who make money from both local and international digital advertising and who need to know how taxes or tax exemptions may apply;

Agricultural or food related businesses seeking to know if their products are tax exempt or not or to which extent they are taxable and if / how they can claim pioneer income tax relief;

Service businesses serving local and/or international clients and seeking to know what is taxable or not;

Importers of cars, spare parts and other commodities, seeking to learn what taxes and import duties they are supposed to pay exactly;

Catering businesses seeking to know which of their foods or services are taxable or not;

Healthcare and pharmaceutical businesses seeking to learn the extent of tax exemptions they are allowed or to what extent they are taxable;

Educational institutions seeking to know if they are tax exempt or not and whether they can be defined as institutions of public character for tax purposes;

Religious institutions and non-profits engaging in income yielding activities or generally seeking to know which of their operations might attract taxes;

Family businesses, trusts and estates seeking to know how and what taxes apply to their holdings;

Companies operating a group structure and seeking to know how the income tax transfer pricing regulations apply to them;

Or

.

And lastly:

Family members of business men and women who may like to know how and what taxes apply to their relations’ businesses – you never know how this may help the relationships!

Or

.

As always, your personal and business information is protected!

To ensure confidentiality of our clients’ information as always, we are using the webinar feature of zoom platform which does not allow participants’ view of other participants names.

Here at Vi-M, we are professional to the core and we keep all client information safe and confidential with us, not disclosing such even among staff members, except strictly on a need-to-know-basis. Because our founders trained with the big-four firms, high ethical standards, professionalism and confidentiality of client and other such information is part of their DNA and ours as a firm.

Or

.

.

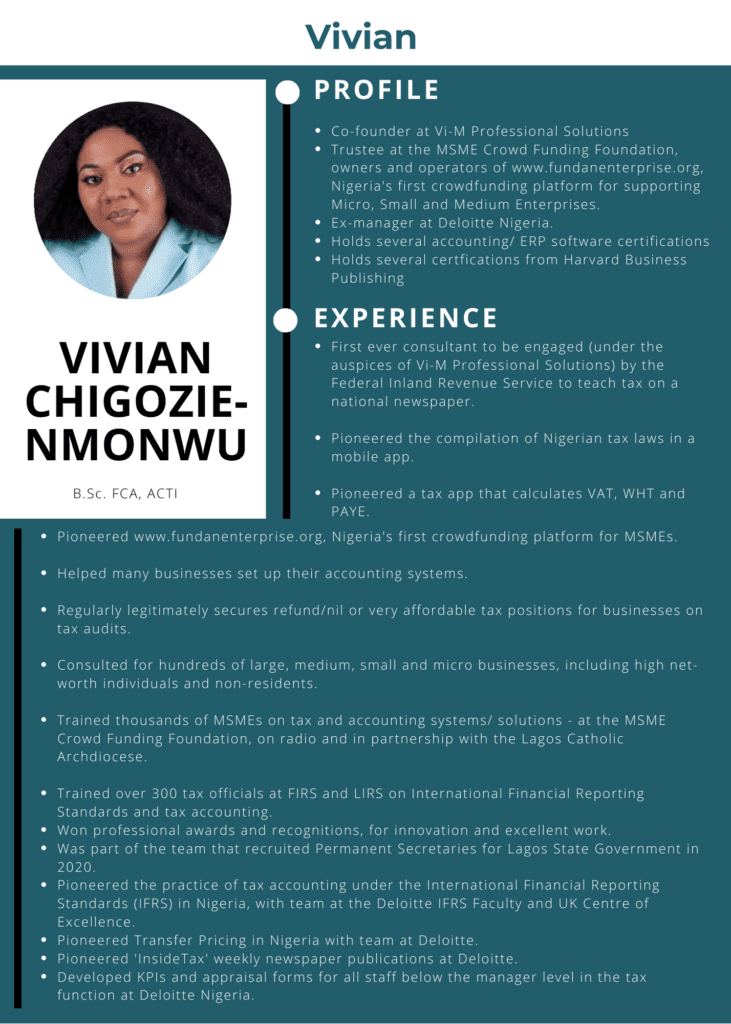

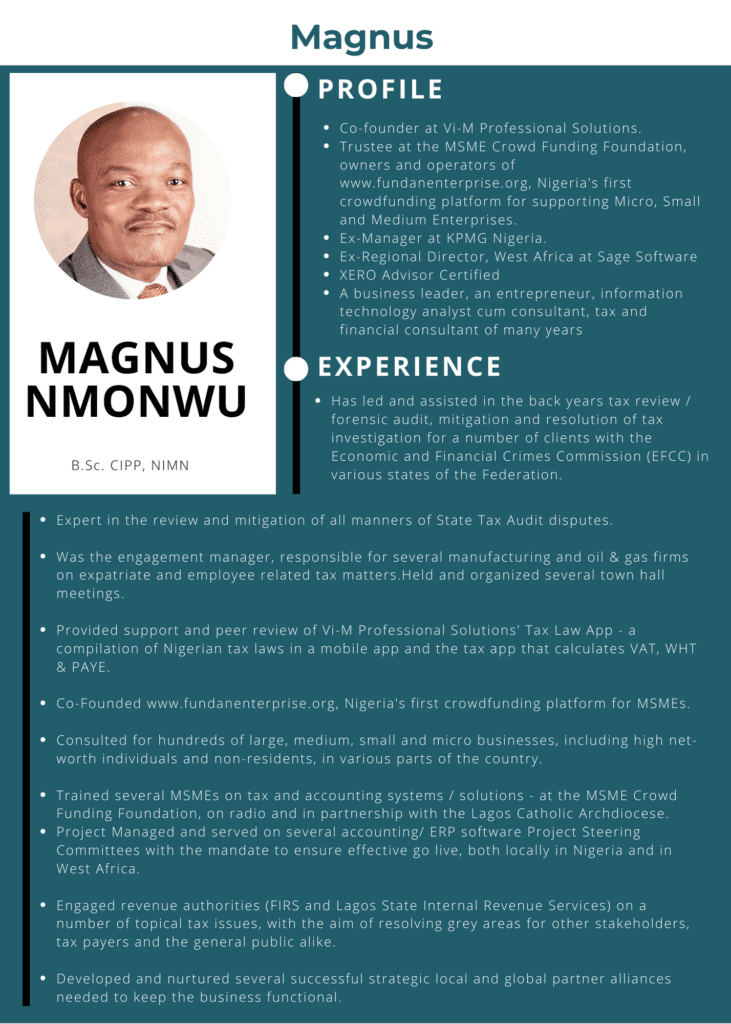

Meet Your Expert Tax Advisors who Facilitate Tax Discourse!

Or

.

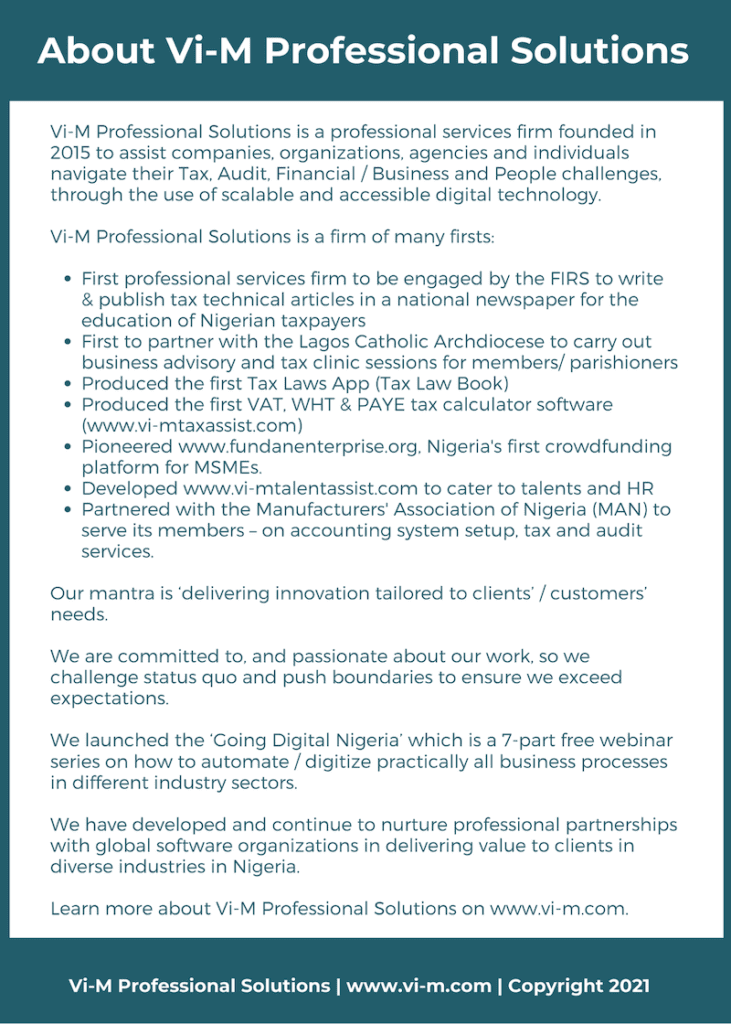

Want to know more about Vi-M Professional Solutions?