Description

Over 40 million micro, small and medium sized businesses in Nigeria are either not registered, or registered as business names and self-employed – meaning their businesses are taxable under the personal income tax. No one ever tells these brilliant entrepreneurs how they can correctly and easily compute/ comply to taxes from their self employed businesses/ hustles.

Many employers of labour in Nigeria also find that they need to have an easy, straight-to-the-point insight/ guide on how to compute, remit and generally comply to PAYE tax requirements for their employees, particularly now that the annual Finance Act is changing tax requirements and making it so cumbersome.

The same goes for employees, students, finance professionals, government officials and even the tax man! – who may want to learn or understand or acquire in-depth practical insights on how personal income tax now works.

If you find yourself in any of these situations (which is most likely), this ebook is a comprehensive personal income tax guide for the self-employed, partners in a business, all employers of labour (including businesses registered as ‘companies’) and all employees too.

It brings all the personal income tax law provisions (up to the Finance Act 2020), statutory compliance processes and acceptable practices into this easy-to-read, easy-to-understand ebook, written in everyday language that resonates with every lay person out there.

It is written in 4 parts, for ease of navigation:

- Meaning of Personal Income Tax, Scope of Application and Laws/ Regulations that Guide this tax

- Taxation of Employees in Nigeria

- Taxation of Self-Employed Persons in Nigeria

- General Clarifications and conclusions.

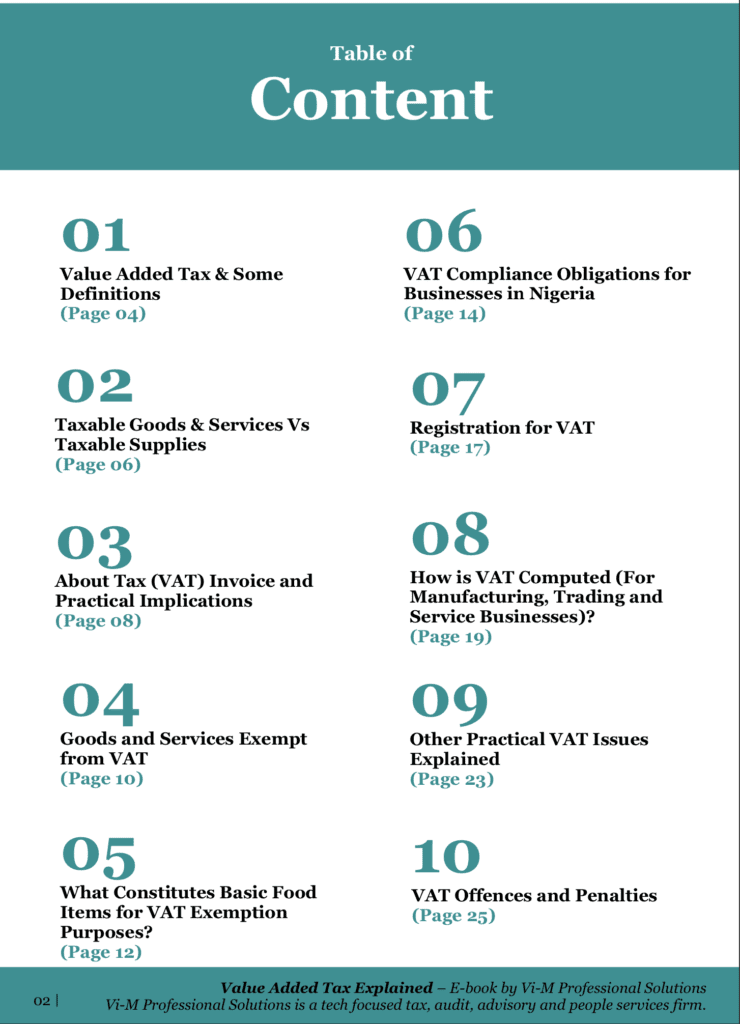

In full details, below are all the contents you will find in this ebook:

Part A

- Personal Income Tax – Meaning, Scope of Application and Legal Bases

Part B – Taxation of Employees in Nigeria

- What is PAYE? / PAYE Tax Rates

- Chargeable and Exempt Incomes from PAYE

- Allowable Deductions & Deductions Not allowed for Employees

- Steps to Calculating PAYE

- Employee & Employer Compliance Requirements

- Tax Registration for PAYE Purposes

- PAYE Payment

- PAYE Requirements for Expatriates

-

Meaning of PIT Direct Assessment/ PIT Rates

- Basis for Computing PIT

- Chargeable and Exempt Incomes from PIT Direct Assessment

- Concept of Capital Allowance

- Concept of ‘Deductibility of Expenses’ from PIT

- Steps to Computing PIT Direct Assessment

- PIT Compliance Requirements for Self-employed Persons/ Businesses

- PIT Registration for Self Employed Persons/ Businesses

- PIT Payment for Self Employed Persons/ Businesses

- How to Apply Withholding Tax Credits for PIT Offset

-

How Self- employed Persons can Join Pension Scheme in Nigeria

Part D – General Clarifications

- Filing of Tax Returns Under the Personal Income Tax Act

- Personal Tax Clearance Certificates

- PIT Compliance for Employees with Side Hustles

- Role of SIRS, FIRS and FCT IRS in Collecting and Administering PIT

Enjoy!

Reviews

There are no reviews yet.