Description

Many taxpayers confuse Withholding Tax (WHT) for many things, other than what it actually is. Many also believe that whatever tax is deducted by the customer from their business invoices, should satisfy all their tax obligations.

There are also students, Finance professionals (or finance graduates), tax/ government officials and non-residents who may want to understand fully what withholding means and how it works in Nigeria, particularly in practice.

If you find yourself in a situation where you need to understand Withholding Tax (WHT) fully, try this ebook.

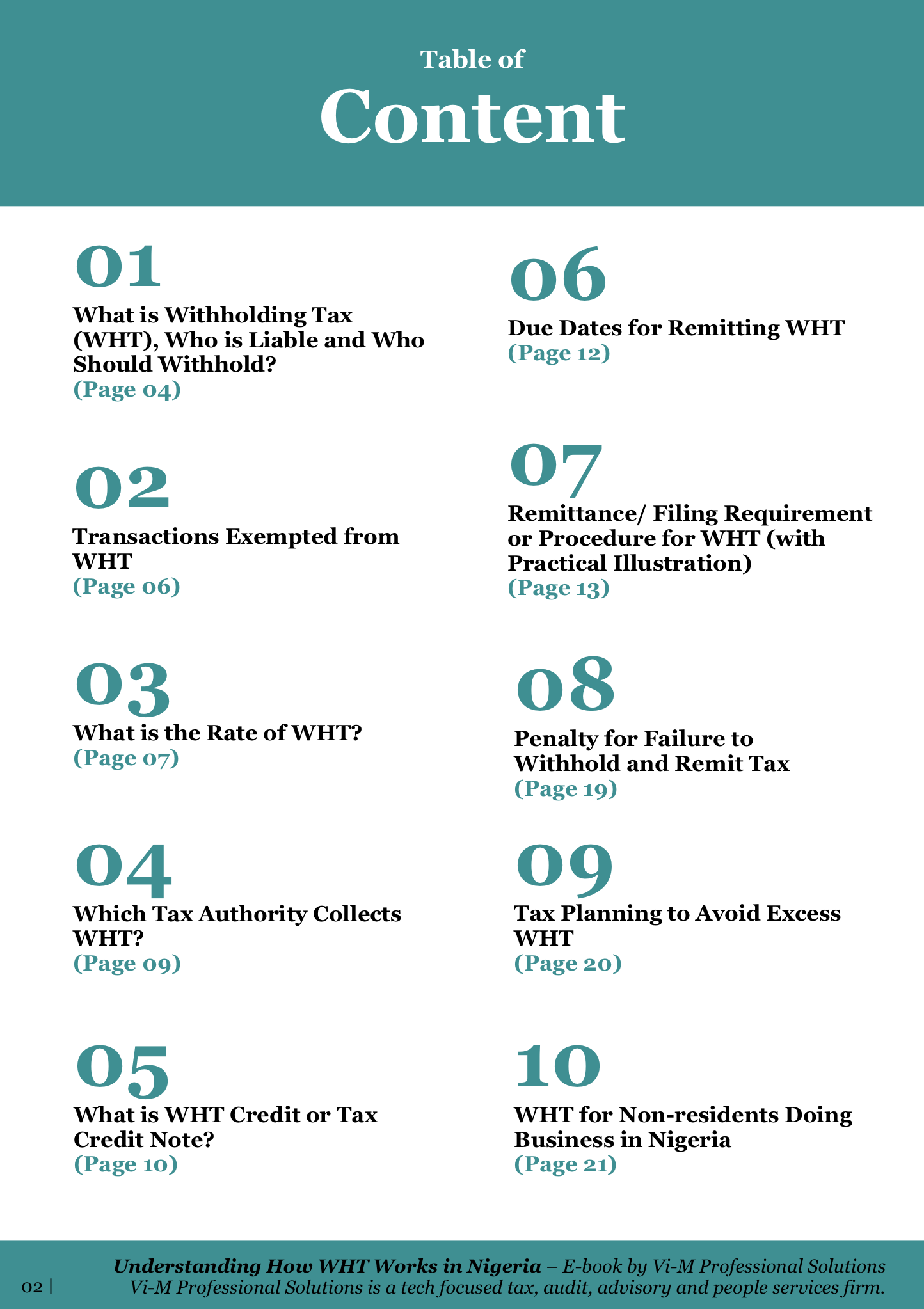

In this ebook, you will learn in details:

- What is Withholding Tax (WHT), Who is Liable and Who Should Withhold?

- Transactions Exempted from WHT

- What is the Rate of WHT?

- Which Tax Authority Collects WHT?

- What is WHT Credit or Tax Credit Note?

- Due Dates for Remitting WHT

- Remittance/ Filing Requirement or Procedure for WHT (with Practical Illustration)

- Penalty for Failure to Withhold and Remit Tax

- Tax Planning to Avoid Excess WHT

- WHT for Non-residents Doing Business in Nigeria

Enjoy it!

Reviews

There are no reviews yet.